March 14, 2024

Webuild Results at December 31, 2023

Excellent results thanks to clear and consistent strategic vision and opportunities offered by structural market trends

2023 guidance exceeded

Double-digit growth in revenues and margins

Outstanding cash generation, gross leverage reduction

Record order backlog, already exceeding 2025 targets

2025 revenues target under “Roadmap to 2025: The Future is now" plan brought forward by one year

- THIRD CONSECUTIVE YEAR OF RECORD NEW ORDERS: ACQUIRED €22 BILLION, OF WHICH €11 BILLION IN FOREIGN MARKETS

- ORDER BACKLOG AT €64 BILLION, FULLY COVERING “ROADMAP TO 2025” PLAN AND PROVIDING VISIBILITY FOR NEXT 6 YEARS

- REVENUES[1]: €10 BILLION (+22% VS. 2022), OF WHICH 66% GENERATED IN FOREIGN MARKETS

- EBITDA[1]: €819 MILLION (+43% VS. 2022); EBITDA MARGIN: 8.2% (7% IN 2022)

- EBIT: €475 MILLION (+48% VS. 2022); EBIT MARGIN: 4.8% (3.9% IN 2022)

- NET PROFIT[1]: €236 MILLION (€118 MILLION IN 2022)

- PROPOSED DIVIDEND: €0.071 FOR EACH ORDINARY SHARE, UP BY 25% COMPARED TO 2022; €0.824 FOR EACH SAVINGS SHARE

- NET CASH OF €1,431 MILLION, A MARKED IMPROVEMENT COMPARED TO NET CASH OF €265 MILLION IN 2022

- GROSS DEBT AT €2,609 MILLION WITH STRONG REDUCTION OF GROSS LEVERAGE TO 3.2 TIMES

- DELIVERED ICONIC PROJECTS SUCH AS BRAILA BRIDGE IN ROMANIA; SIGNIFICANT PROGRESS ON OTHERS, INCLUDING MILAN'S METRO M4, MILAN-GENOA HIGH-SPEED RAILWAY, SNOWY 2.0 HYDRO PLANT IN AUSTRALIA, GRAND PARIS EXPRESS LINE 16 AND SHIP CANAL WATER QUALITY PROJECT IN USA

- SUCCESSFULLY MANAGED CHALLENGE OF WORKER SHORTAGE: OVER 87,000 OF WORKERS ON PROJECTS WORLDWIDE, OF WHICH 16,900 IN ITALY; OVER 12,000 NEW HIRES

- NEW ORDERS AT APPROXIMATELY €4.9 BILLION SO FAR IN 2024

- SIGNIFICANT PROGRESS ON ESG AMBITIONS OVER THE YEAR; SET NEW 2025 TARGETS BASED ON INVESTMENTS IN HEALTH AND SAFETY, INCLUSION, INNOVATION AND CLEAN TECHNOLOGIES

****

2024 GUIDANCE

ANOTHER YEAR OF STRONG GROWTH WITH EXPECTED REVENUES HIGHER THAN €11 BILLION AND EBITDA HIGHER THAN €900 MILLION; FOCUS ON CASH GENERATION CONTINUES WITH MAINTENANCE OF SOLID NET CASH POSITION OF MORE THAN €400 MILLION

****

MILAN, March 15, 2024 – The Board of Directors of Webuild (MTA: WBD) approved yesterday the consolidated financial results and the separate draft financial statements at December 31, 2023, as well as examined the “Adjusted Consolidated Data” for the purpose of a better comparison on a like-for-like basis.

***

In 2023, the Webuild Group further consolidated its development trajectory begun in 2012, posting all-time high results, made possible by a clear and consistent strategy that was supported by global mega trends that have given a strong boost to infrastructure investments.

A winning strategy that consists of three pillars: i) focus on building highly complex and innovative infrastructures and becoming a reference partner for our clients worldwide; ii) consolidation of leadership position in key markets such as Europe, Australia, the United States and the Middle East, continuing with policy of risk mitigation; iii) greater scale that has allowed us to invest in innovation, training, health and safety and on strategic projects to de-risk business, improve profitability and cash generation, as well as deleveraging.

Following the solid track record of operating results achieved in recent years, Webuild closes 2023 exceeding the guidance for the year. Revenues stood at €10 billion and EBITDA at €819 million. Operating cash flow generation was outstanding with a net cash position of €1,431 million, while gross leverage reduced to 3.2 times compared to 4.6 times in the previous year.

For the third consecutive year, Webuild posted a record order intake, with acquired orders totaling €22 billion and a book-to-bill of 2.7 times, far exceeding the target of 1.1 times for the year. The total order backlog also reached an all-time high of €64 billion, exceeding the target set for 2025 under the plan. In addition to covering 100% of the 2023-2025 Business Plan's revenue and EBITDA targets, the backlog gives more than six years' visibility on the Group's revenue, establishing a clear growth trajectory for the Group.

Demonstrating its ability to seize opportunities arising from megatrends such as climate change, energy transition, resource scarcity and population growth, Webuild has been confirmed as the global leader in the water sector, as well as ranked among the top 10 international contractors in both the United States and Australia. It is also among the top 10 for sustainable mobility projects, according to Engineering News-Record (ENR), the authoritative U.S. magazine in the field.

In 2023, the Group completed projects crucial for the development in their respective regions, such the second longest suspension bridge in Continental Europe over the Danube River in Braila, Romania. It also reached major milestones on other projects, including the Tricolore and San Babila stations on Milan's M 4 metro line, which allows passengers to reach the city centre from the airport in 12 minutes; the Isarco Underpass Tunnel, part of the Brenner Base Tunnel, the longest underground railway link in the world; and Eni's new headquarters in Milan.

2023 marked a year of significant progress for the Group’s ESG ambitions, exceeding targets set under the 2021-2023 Environmental, Social and Governance (ESG) plan. Webuild reduced its emissions intensity rate by 67% (compared to the 2017 baseline), outperformed the 50% reduction target set for 2025 under the Sustainability-Linked Financing Framework. In health and safety, the Lost-Time Injury Rate (LTIFR) showed further improvement in 2023, after reaching the target set for the previous year (-41% compared to the target of -40% to 2022). In addition to the recent confirmation as a 'world leader in climate change action' by CDP (formerly the Carbon Disclosure Project), Webuild was promoted to 'AA' by MSCI ESG Ratings in recognition of its commitment to corporate governance and health and safety.

In 2023, M&A activities continued with the acquisition of Australian company Clough, enabling it to position itself among the top five players in Australia. It also sold its share in the concession related to Milan’s M4 metro line for €141 million.

The breadth and quality of the order backlog, as well as the leading position the Group holds in countries that are implementing major infrastructure investment plans, has made it possible to anticipate by one year the revenues target under the “Roadmap to 2025 - The future is now” plan to 2024 from 2025.

****

ADJUSTED CONSOLIDATED INCOME STATEMENT DATA AT DECEMBER 31, 20231

Adjusted revenues for the financial year 2023 amounted to €9,994 million (€8,163 million in 2022) and showed year-on-year growth of €1,831 million, up 22%. This increase was the result of the development of operating activities in Italy amid investments in sustainable mobility under the National Recovery and Resilience Plan (PNRR in Italian), including high-speed railway projects Milan-Genoa, Verona-Padua and Naples-Bari; and the 106 Ionian state road. There was also an increase in production in projects in Australia (Snowy 2.0, the North East Link and SSTOM) and the Middle East (Diriyah Square Super Basement).

Adjusted EBITDA amounted to €819 million, up 43% year-on-year from €572 million in 2022, while adjusted EBIT reached €475 million (€321 million in 2022), up 48% year-on-year.

The improvement in margins is the result of a high-quality order backlog, which includes projects acquired on the basis of best technical offer, with contracts containing clauses to adjust for inflation, and the implementation of the program to reduce operating costs.

Adjusted net financial costs showed net expenses of approximately €92 million, compared to €73 million in 2022.

This item includes:

- financial charges of €245 million (€213 million in 2022), partially offset by financial income of €119 million (€119 million in 2022);

- positive net exchange result of €34 million (positive for € 20 million in 2022), mainly due to fluctuations in the euro against the Nigerian naira and Colombian peso.

The increase in financial charges is mainly attributable to (i) the increase in the cost of debt due to the trend in reference interest rates, which affects the portion of financial debt at variable rates; and (ii) the reversal of interest income on delayed payments by the Ethiopian customer following the contractualization of its claims.

Adjusted profit before tax amounted to €393 million (€252 million in 2022), an increase of 56%.

Adjusted income taxes amounted to €143 million (€109 million in 2022).

The adjusted result from continuing operations is a positive €250 million (€143 million in 2022), an improvement of 75% year-on-year.

The result from discontinued operations shows a net expense of €10 million (€18 million in 2022) and refers to the former Astaldi foreign divisions that do not meet Webuild’s commercial and industrial planning strategies (mainly Central and South America for 2023 earnings figures).

Profit attributable to minority interests amounted to €4 million (€7 million in 2022).

The above dynamics resulted in an adjusted net profit attributable to the Group of €236 million, effectively doubling the results achieved in 2022 (€118 million).

****

CONSOLIDATED BALANCE SHEET DATA AT DECEMBER 31, 2023

The net financial position of continuing operations as at December 31, 2023 was positive (net cash) in the amount of €1,431 million, the best result ever achieved by the Group. The marked improvement of €1,166 million compared to December 31, 2022 (€265 million) is attributable to the positive performance of industrial activities and the change in net working capital. Measures were undertaken to constantly optimise working capital dynamics and quality, including the cash in of certain slow-moving items. There were also significant results achieved at the commercial level during 2023.

Gross debt stood at €2,609 million, an improvement of €11 million compared to December 31, 2022 (€2,619 million). The Gross Debt/EBITDA ratio at December 31, 2023, on a consolidated basis, was 3.2 times, down from 4.6 times at December 31, 2022. Group reports total cash and cash equivalents of €3,061 million.

At December 31, 2023, 89% of the outstanding amount of corporate loans were at fixed interest rates, with the first significant maturities in the fourth quarter of 2024.

****

ORDER BACKLOG AND NEW ORDERS

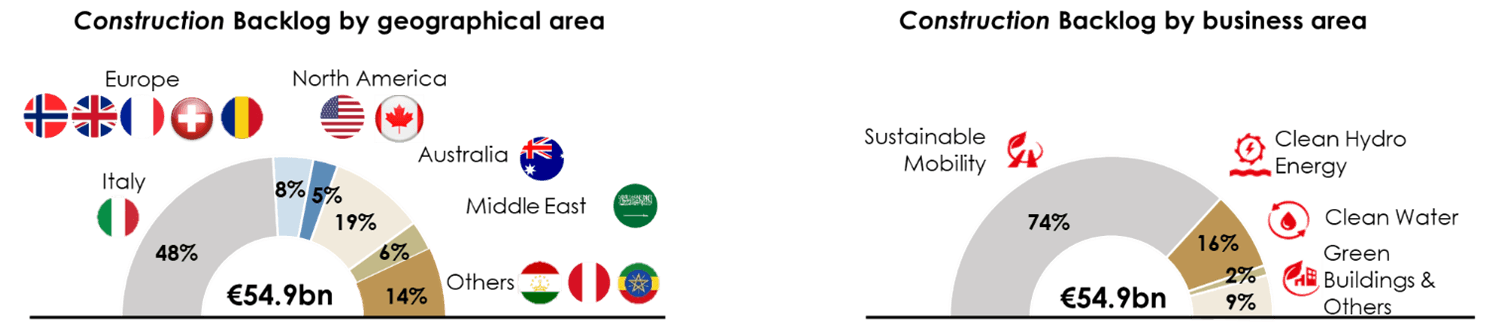

In 2023, total order backlog stood at €63.7 billion, of which €54.9 billion were related to construction and €8.9 billion to concessions, and operation and maintenance. The construction backlog increased by 25% against that recorded for 2022.

More than 90% of the Group's construction backlog involves projects linked to the advancement of the United Nations Sustainable Development Goals (SDGs). In terms of markets, the order backlog is mainly distributed among Italy, Central and Northern European countries, the United States, Middle East and Australia countries that represent 85% of the construction backlog. The projects are in sectors related to sustainable mobility, such as rail, high-speed rail and surface transport.

The following is a breakdown of the construction backlog by geographical and business areas:

Total new orders, including variation orders, amounted to approximately €22.4 billion, of which more than 95% in key markets with low-risk profiles. Below is the geographical distribution of the new orders and the list of main contracts acquired:

Since the beginning of 2024, new orders, including projects for which Webuild is the preferred bidder, amount to approximately €4.9 billion.

****

COMMERCIAL PIPELINE

Webuild’s short-term commercial pipeline amounts to approximately €76.8 billion and includes tenders submitted and pending for approximately €13.3 billion.

The Group continues to monitor various markets such as Europe, Australia, North America and the Middle East, which have embarked on significant infrastructure development plans - a major driver of economic activity and a facilitator for energy and climate transition efforts.

In Europe, infrastructure investments are benefitting from funds made available by the Next Generation EU Fund. In addition, the European Union launched the €208 billion REPowerEU program to support energy transition plans with investments in clean energy and energy saving initiatives, in addition to €600 billion included in the European Green Deal already allocated to direct interventions to face climate change.

In Australia, new investments will be mainly driven by climate and energy segment, with more than AU$40 billion linked to the Powering Australia Plan approved in 2021, which aims to make the country a leader in clean energy production. An impulse to the infrastructure market will also be provided by further investments in the water and resources segments.

In the United States, there are the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA) and the CHIPS and Science Act, all of which will contribute to strong growth in the infrastructure sector, mainly railways and roads, energy and industrial infrastructure.

In the Middle East, there are ambitious investment programs like “Saudi Vision 2030” in Saudi Arabia aimed at diversifying the kingdom's economy, reducing oil dependency and encouraging tourism. It includes giga projects such as NEOM and Diriyah, where Webuild has recently acquired a number of orders. A further boost to investment is expected to come from EXPO 2030 and FIFA World Cup 2034.

Below is a breakdown of the pipeline by category and geography:

OUR COMMITMENT TO SUSTAINABILITY

2023 marked a year of significant progress for the Group's ESG ambitions. In addition to its recent confirmation as a” world leader in climate change action” by CDP (former Carbon Disclosure Project), Webuild was upgraded to “AA” by MSCI ESG Ratings in acknowledgement of its commitment to corporate governance and health and safety.

Affirming its position among the top players in the sector, the Group also maintained a top rating from other ESG rating agencies, such as ISS-ESG with” B- Prime level” and Moody's ESG (former Vigeo Eiris) with “Advanced level”, as well as being part of the MIB® ESG Index of the Italian Stock Exchange.

2023 marked the year of completion of the ESG Plan, defined in 2021, which aimed at improving the environmental sustainability of the Group's projects and activities, helping to optimise the sector's efficiency in terms of health, safety, diversity and inclusion, by leveraging innovation and digitalisation. Webuild has largely achieved its goals and has consolidated its position in terms of sustainability.

Among its achievements, Webuild exceeded its aim of reducing the rate of GHG emissions intensity (Scope 1 and 2), down 67% from the 2017 baseline, compared with the 2025 target of minus 50%. Furthermore, additional investments in innovative high-potential projects to be realised by 2023 doubled compared with expectations, reaching more than €57 million, far above the planned €30 million.

In line with the plan's targets, the injury rate - referred to as LTIFR - decreased by 41% in 2022 compared to the 2017 baseline and improved further in 2023.

Finally, the 25% percentage target of women identified for the company's succession planning process was achieved.

Confirming Webuild's constant commitment, the Group will further invest in sustainability, setting new ambitious targets by 2025.

With the new Plan, the Group intends to continue to: (i) contribute to accelerating the climate transition towards a low-emission economy, investing in clean technology, improving the environmental sustainability of construction sites as well as of the infrastructures once completed; (ii) represent the sector benchmark in terms of health and safety, skills development, inclusion and efficiency, through investments in innovation and digitalization.

The new Plan is based on the same three main pillars which guided the Group successfully in the last years ( Green, Safety & Inclusion, Innovation), with the following new targets:

- reduce the intensity of greenhouse gas emissions by 10% by 2025 (versus 2022);

- reduce the Lost Time Injury Frequency Rate (LTIFR) by 6% by 2025 (versus 2022);

- increase the number of female managers in the group by 20% by 2025;

- €430 million of investments in cleantech and high-potential innovative projects by 2025.

****

OUTLOOK

The results for financial year 2023, with economic-financial performance above expectations, together with a global market characterized by massive investment plans and the breadth and quality of the backlog, allow the Group to be very confident on the future prospects and to bring forward to 2024 the revenues target that had been set for the end of the “Roadmap to 2025 - The Future is Now” plan.

For 2024, is expected a book-to-bill higher than 1.0x and another year of growth with revenues higher than €11 billion and EBITDA higher than €900 million. Furthermore, the Group will continue to focus on cash generation, maintaining a solid net cash position of more than €400 million.

Webuild, in line with the Roadmap to 2025, will continue to pursue its strategic lines through:

- the evolution and expansion of the business by leveraging on: i) the order backlog; ii) the organisation, people, know-how and local presence in the main target markets, with a focus on lower risk countries; iii) valorisation of subsidiaries;

- the operational efficiency plan and cash generation;

- investment in worker safety, innovation and environmental sustainability.

****

MAIN SIGNIFICANT EVENTS OCCURRING AFTER THE END OF THE YEAR

On 17 January 2024, Webuild Group was awarded a contract worth USD 4.7 billion to build an advanced ski resort in Trojena, as part of the futuristic NEOM project in Saudi Arabia. This project, characterised by the construction of three dams to feed the largest artificial freshwater lake in Saudi Arabia, represents an unprecedented infrastructure project in the Saudi desert mountains. The works will also include “The Bow”, a futuristic architectural work with a luxury hotel overlooking the valley. In addition to promote the development and regeneration of the Trojena area, which will host the 2029 Asian Winter Games, the project is part of Saudi Vision 2030 for the economic diversification of the country.

On 21 January 2024, WeBuild, the joint venture leader (with a 50% share) with Fomento de Construcciones y Contratas Canada Ltd, signed a contract for the development and construction of the “Pape Tunnel and Underground Stations (PTUS)” section of the new Ontario Line, a rapid underground project that will change the face of transport in the city of Toronto. The PTUS project includes three kilometres of tunnels and two underground stations, part of a metro system that will reduce travel time and support the projected population growth from six to eight million by 2030. The work, with a total estimated value of approximately €700 million - €1.3 billion (CAD 1-2 billion), will be executed as a “Progressive Design-Build”, an innovative contract model involving close collaboration between the client, contractor and designer, meaning lower execution risks in the start-up and construction phases of the project. The final value will be determined by the final design.

On February 9, 2024, a consortium led by Cossi Costruzioni (Webuild Group) was awarded the contract for the design and structural adjustment of four viaducts on the A25 Torano-Pescara motorway to improve road safety. The contract, worth a total of €131 million, will be 60% carried out by Cossi Costruzioni.

On February 21, 2024, CDP (formerly Carbon Disclosure Project), as part of its Climate Change 2023 Programme, confirmed Webuild as a world leader in climate change action, allocating it a “A-” rating, above the European and sector average.

On February 29, 2024, the main shareholders of Webuild, Salini S.p.A. and CDP Equity S.p.A. - a company controlled, managed and coordinated by Cassa Depositi e Prestiti S.p.A. - renewed the existing shareholders' agreement, with a maturity date of February 28, 2027. It includes reciprocal commitments with regard to matters of governance and the stability of the shareholder arrangement of Webuild.

On March 5, 2024, the Webuild Group, through its U.S. subsidiary Lane, won a design-and-build contract as part of an expansion of a section of the Seminole Expressway/SR 417 state road in Seminole County, in Florida. Commissioned by Florida's Turnpike Enterprise (Florida Department of Transportation), the contract has a total value of USD 299 million (approximately €276 million).

FURTHER BOARD OF DIRECTORS’ RESOLUTIONS

Notice of the Annual General Meeting

The Board of Directors resolved to convene the Ordinary and Extraordinary Shareholders' Meeting for 24 April 2024 (single call) (to resolve, inter alia, on the proposal to amend the Articles of Association received from the shareholder Salini S.p.A. as the previous announcements of 4 and 7 March 2024). In this regard, reference should be made to the notice of call of the Shareholders' Meeting which will be published within the terms of the law.

Based on annual profits and the distribution of ‘Other reserves of demerger surpluses’, the Board of Directors will propose at the aforementioned Shareholders' Meeting the distribution of a total unit dividend of €0.071, before tax for each ordinary share entitled to the dividend on the ex-dividend date, and €0.824 before tax for each savings share. The Board of Directors also resolved to set the ex-dividend date of the above-mentioned ordinary and savings dividends on 20 May 2024 and the payment date on 22 May 2024 (record date: 21 May 2024).

****

Purchase and Disposal of Treasury Shares

The Board of Directors resolved to submit to the shareholders a proposal to renew the authorization to purchase and dispose of treasury shares, subject to revocation of the previous authorization resolution passed by the shareholders' meeting of 27 April 2023, for the part that remained unexecuted, having the following characteristics.

Reasons for the request for authorization

The main objectives for which this authorization is requested are as follows: a) operate on the market, in compliance with the legal and regulatory provisions in force and through intermediaries, to support the liquidity of the security and to regularize the performance of trading and prices , in the presence of any fluctuations in prices that reflect anomalous trends, also linked to excess volatility or poor trading liquidity and/or placements on the market of shares by Shareholders having the effect of affecting its price and/or , more generally, to contingent market situations; b) medium and long-term investment or in any case in order to seize market opportunities also through the purchase and resale of shares whenever appropriate; c) acquire a portfolio of treasury shares that can be used in the context of any extraordinary finance and/or incentive transactions and/or for other uses deemed of financial, managerial and/or strategic interest for the Company. The purchase transactions are not instrumental in reducing the share capital by canceling the treasury shares purchased.

Maximum number of ordinary shares that can be purchased

The proposed authorization concerns the granting to the Board of Directors of the right to purchase ordinary shares of the Company, in one or more tranches, to an extent freely determined by the Board of Directors, up to a maximum number of ordinary treasury shares, such as not to exceed 10% of the total number of shares outstanding at the time of the transaction, also having regard to any ordinary treasury shares held by the Company itself at that date both directly and indirectly through its subsidiaries. At the closing of the market on march 14, 2024, the Company holds no. 21,877,494 treasury shares (equal to 2.15% of the Company's ordinary share capital) and the Webuild Group companies included in the scope of consolidation hold 2,915,242 Webuild shares (equal to 0.29%of the Company's ordinary share capital).

Period of validity of the shareholders' meeting authorisation

The authorization to purchase treasury shares is requested for the maximum term permitted by applicable laws and regulations, currently 18 months from the date on which the shareholders' meeting adopts the corresponding resolution, with the faculty of the Board itself to proceed with the transactions authorized on one or more occasions and at any time, to an extent and at times freely determined in compliance with the applicable rules, with the gradualness deemed appropriate in the interest of the Company. The authorization to dispose of treasury shares is requested without time limits.

Indication of the minimum and maximum price

The purchase of treasury shares is requested for a unit price which cannot in any case deviate, either downwards or upwards, by more than 20% with respect to the reference price recorded by the share in the trading session preceding each single transaction or (where lower ) to the different percentage possibly established as the maximum limit by the provisions of the law or regulation or by the Market Practices applicable from time to time, and in any case in compliance with the operating conditions established by the same. The sale of treasury shares may be carried out at the price or, in any case, according to criteria and conditions determined by the Board of Directors, having regard to the implementation methods used, the trend in share prices in the period preceding the transaction and the best interests of the Company.

Methods for undertaking the purchases

It is requested that the authorization be granted for the purchase of treasury shares, also through subsidiaries, to be identified, from time to time, at the discretion of the Board itself.

For any further information regarding the aforementioned proposal to authorize the purchase and disposal of treasury shares, please refer to the Explanatory Report of the Board of Directors to the Shareholders' Meeting, pursuant to art. 73 of the Issuers' Regulation, which will be made available to the public within the terms and in the manner prescribed by law.

****

The notice calling the Shareholders' Meeting, the explanatory reports on the items on the agenda, together with the 2023 Annual Financial Report, the Annual Report on corporate governance and the ownership structure and the Report on the Remuneration Policy and Compensation Paid, will be made available to the public within the terms and in the manner prescribed by law.

It should be noted that participation in the Shareholders' Meeting will be permitted exclusively through the "Designated Representative". To this end, the Company has conferred this task on Monte Titoli., to which the holders of voting rights will be able to grant proxies, within the terms and with the methods illustrated in the notice of call which will be made available to the public within the terms and with the legal procedure to which reference is made.

****

Massimo Ferrari, as manager in charge of preparing the corporate accounting documents, declares, pursuant to paragraph 2 of art. 154-bis of the TUF, that the accounting information contained in this press release corresponds to the state of the documentary evidence, books and accounting records.

****

The Group's results for the 2023 financial year will be presented to the financial community on March 15, 2024 during a conference call at 9:30 a.m. CET (UTC +01:00).

For information, please refer to the contact details at the end of this press release.

****

Disclaimer

This press release contains forward-looking statements. These statements are based on the Group's current expectations and projections regarding future events and, by their nature, are subject to an inherent component of risk and uncertainty. They are statements that relate to events and depend on circumstances which may or may not happen or occur in the future and, as such, undue reliance should not be placed on them. Actual results may differ even significantly from those announced due to a variety of factors, including: volatility and deterioration of capital and financial markets, changes in commodity prices, changes in macroeconomic conditions and growth economic and other changes in business conditions, of an atmospheric nature, due to floods, earthquakes or other natural disasters, changes in legislation and the institutional context (both in Italy and abroad), difficulties in production, including constraints in the use of plants and supplies and many other risks and uncertainties, the majority of which are beyond the control of the Group.

[1]The data reported are adjusted economic data; for details, see the table attached to the press release

[2]Related to Highways, Mass transit and rail segments

Reclassified Statement Of Profit Or Loss Adjusted