July 28, 2023

Webuild results at June 30, 2023

Record order backlog, covering 100% of revenue, ebitda targets for 2023-2025

Double-digit growth in operating results

Strong improvement in net cash position

- €17.7 billion in new orders year-to-date; 2023 new order target overachieved

- Total order backlog reached €61 billion; record construction order backlog at €51.4 billion (more than half abroad)

- Tenders awaiting outcome over €13 billion

- Growing operating results

- Revenues: €4.6 billion (+18% vs first half 2022)

- Ebitda1: €289 million (+15% vs first half 2022)

- Ebit1: €139 million (+12% vs first half 2022)

- Positive financial position (net cash) of €438 million, €835 million improvement from june 30, 2022, €173 million improvement from december 31, 2022

- Delivery of strategic infrastructure such as the Bridge across the Danube River in Braila (Romania), second longest suspension bridge on continental Europe, and San Babila station of Milan's Metro 4, which reaches Linate airport in 12 minutes

- More than 90% of group's construction backlog related to projects linked to advancement of u.n. sustainable development goals (sdg)

- 2023 guidance confirmed

- Revenues: €9.0 – 9.5 billion

- Ebitda: €720 – 760 million

- Maintain positive Net Financial Position (net cash)

****

MILAN, July 28, 2023 – The Board of Directors of Webuild (Euronext Milan: WBD) approved yesterday the consolidated half-year financial report at June 30, 2023 and examined the “Adjusted Consolidated Data1” for the purpose of a better comparison on a homogenous basis.

****

Since the beginning of the year, the Webuild Group has recorded an outstanding performance, also from a business perspective, with new orders worth €17.7 billion, significantly exceeding the guidance of €10 – 10.5 billion for full-year 2023. This result confirms the strength and durability of market trends of this era, such as climate and energy transition as well as population growth, which, together with the quality of the Group’s offerings, have underpinned the remarkable order intake registered in the past three years.

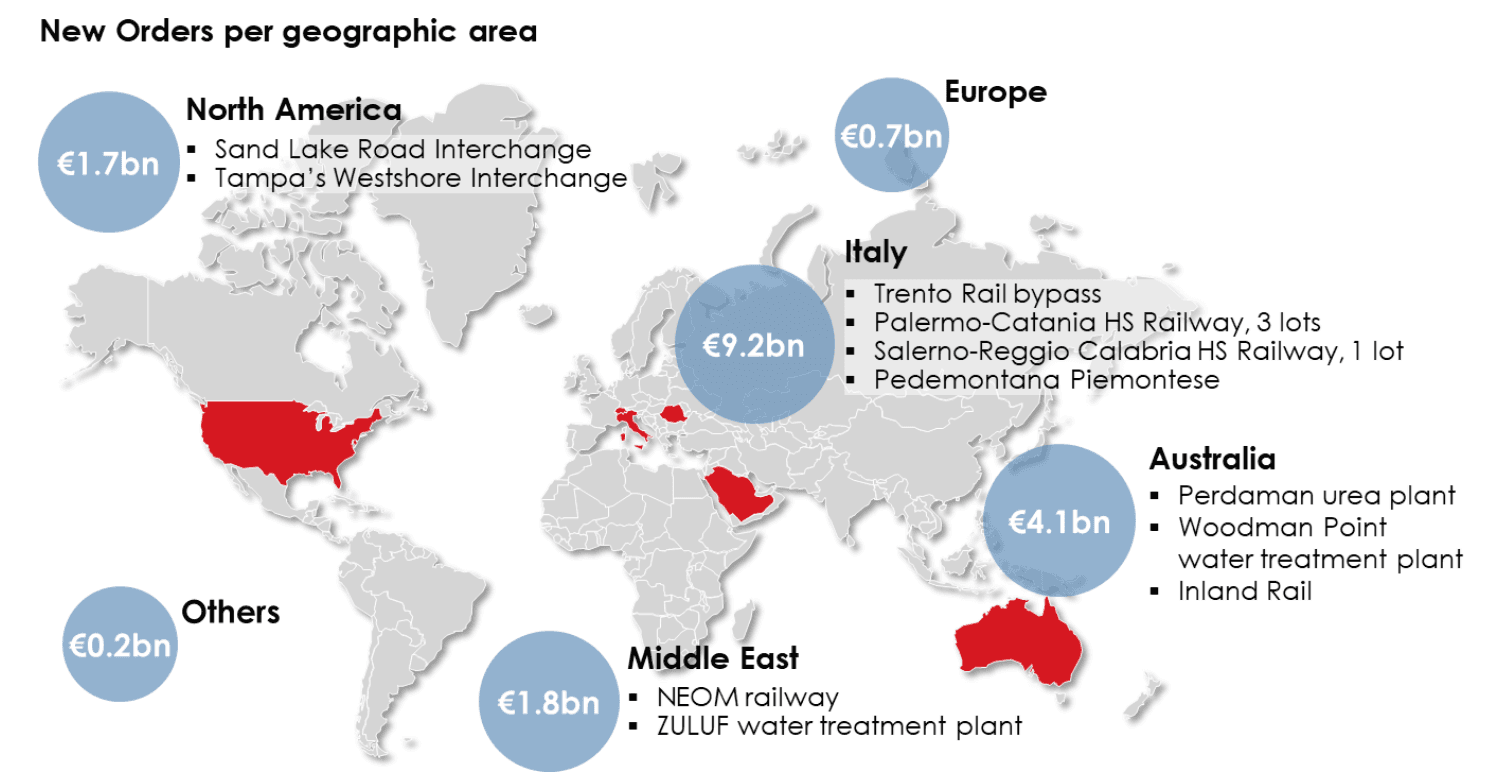

A large part of new orders continue to come from foreign markets such as Australia - a key country where the Group recently completed the acquisition of the Australian company Clough; the United States; Saudi Arabia; and other countries in Europe. In Italy, the first months of the year saw a strong acceleration of public tenders for infrastructure projects with contracts amounting to more than €9 billion for the Group.

Construction order backlog at June 30, 2023 standing at a record of more than €51 billion, covering 100% of target revenues for 2025. This puts the Group in a strong position to face future challenges, thanks in part to an excellent balance in low-risk markets such as Italy, central and northern Europe, the United States and Australia, which comprise about 78% of the backlog.

At the operational level, the Group recorded a higher performance. Revenues grew by 18% to €4.6 billion, and EBITDA by 15% to €289 million. The financial performance was particularly significant, with the positive financial position (net cash) of €438 million, improving by over €835 million compared to June 30, 2022.

Since the beginning of 2023, Webuild also delivered several infrastructures, including some iconic ones, that will improve millions of people’s quality of life.

There was the inauguration of the San Babila – Linate section of the M4 metro line in Milan, which connects the city centre to Linate airport in just 12 minutes; the inauguration of the Bridge across the Danube River in Braila (Romania), the second longest suspension bridge on continental Europe, very similar to the future bridge over the Strait of Messina; and the completion of ENI’s futuristic new head offices in Milan. The start of works on Genoa’s new breakwater and the Venezia Square Station of the C metro line in Rome are just some of the most significant milestones reached by the Group as it supports sustainable development through innovation.

In light of the strong results achieved in the first half of the year, the solid order backlog and the commercial positioning in low-risk markets - paired with a strong leadership in the domestic market - Webuild confirms its guidance for 2023.

****

ADJUSTED CONSOLIDATED INCOME STATEMENT AT JUNE 30, 202

Adjusted revenues, relating to the first half of 2023, amounted to €4,564 million (€3,873 million in first half 2022), with an increase compared to the first half of 2022 of €691 million, equal to 18%. The increase was supported by the development of activities in the domestic market, thanks to investments in sustainable mobility as part of the PNRR (Milan-Genoa, Verona-Padua and Naples-Bari high-speed/high-capacity railways), and by increased production from orders in Australia (Snowy 2.0 and Melbourne's North East Link) and in the Middle East (Diriyah Square Super Basement in Saudi Arabia).

Adjusted EBITDA stood at €289 million (EBITDA margin 6.3%), up 15% compared to the first half of 2022 (by €37 million), while adjusted EBIT reached €139 million (EBIT margin at 3.0%), up by 12% compared to the first half 2022 (by €14 million).

Net financial costs show net charges of approximately €68 million compared to an income of €50 million in the first half of 2022. This item includes:

- financial charges of €111 million (€89 million in first half 2022), partially offset by financial income of €32 million (€67 million in first half 2022);

- positive net exchange rate result of €10 million (positive €72 million in first half 2022).

The increase in net expenses is mainly attributable to: i) currency management, which in the first half of 2022 had benefitted from the marked strengthening of the U.S. dollar against the euro; ii) the decrease in financial income - the first half of 2022 benefitted from financial income totalling €29 million related to the discharging of debts recognised after authorisation of the composition with creditors procedure for Afragola FS and interest collected after settlement of the court proceedings related to Lot 4 of the Orastie – Sibiu Motorway in Romania; as well as iii) the increase in the cost of debt due to the trend in reference interest rates.

Adjusted result before taxes amounted to €77 million (€174 million in first half 2022).

Adjusted income taxes amounted to €49 million (€71 million in first half 2022).

Adjusted result of continuing operations was positive for €28 million (positive for €102 million in first half 2022).

Result from discontinued operations showed a net charge of €1 million (negative for €15 million in first half 2022).

Minority interests were €4 million (profit of €24 million in first half 2022).

The dynamics described above determine an adjusted net profit attributable to the Group of €23 million (profit of €64 million in first half 2022).

****

CONSOLIDATED BALANCE SHEET DATA AT JUNE 30, 2023

The net financial position of continuing operations at June 30, 2023 was positive at €438 million, an improvement of €173 million compared to December 31, 2022 (positive at €265 million) and a marked improvement of €835 million compared to June 30, 2022 (net debt of €397 million).

The results achieved in the current half-year are attributable to the positive performance of the operational activities and a reduction in working capital which also benefits from the Group's excellent commercial performance.

Gross debt stands at €2,671 million, a slight increase of €52 million compared to December 31, 2022 (€2,619 million), but a reduction of €104 million compared to June 30, 2022 (€2,775 million).

At the same time, the Group reports total cash and cash equivalents of €2,114 million.

****

ORDER BACKLOG AND NEW ORDERS

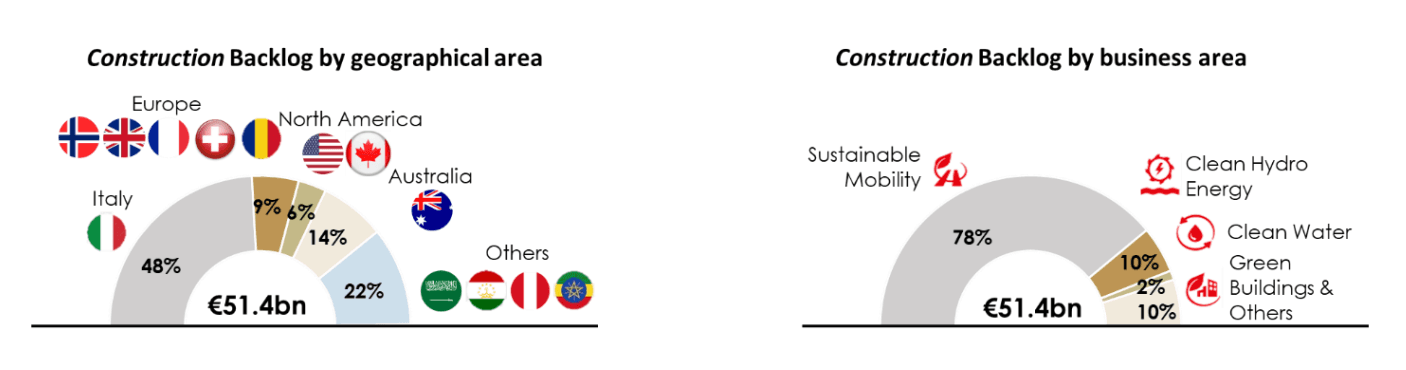

In the first half of 2023, the total order backlog stood at €60.7 billion, of which €51.4 billion related to construction and €9.4 billion to concessions, and operations and maintenance. The construction backlog increased by around 17% from December 31, 2022.

More than 90% of the Group's construction backlog relates to projects linked to the advancement of the United Nations Sustainable Development Goals. In terms of markets, the Group’s de-risking strategy saw the order backlog mainly distributed among Italy, central and northern European countries, the United States and Australia – countries that represent 78% of the total. The projects are in sectors related to sustainable mobility, such as rail, high-speed rail and surface transport. The following is a breakdown by geographic and business areas:

Total new orders acquired and in the process of being finalised since the beginning of the year amounted to €17.7 billion, including €4.4 billion worth of projects for which Webuild is the preferred bidder. The latter will be included in the Group’s backlog upon receipt of the official notification of the tender award by the client. Below is the geographical distribution of the new orders and the list of main contracts acquired:

****

COMMERCIAL PIPELINE

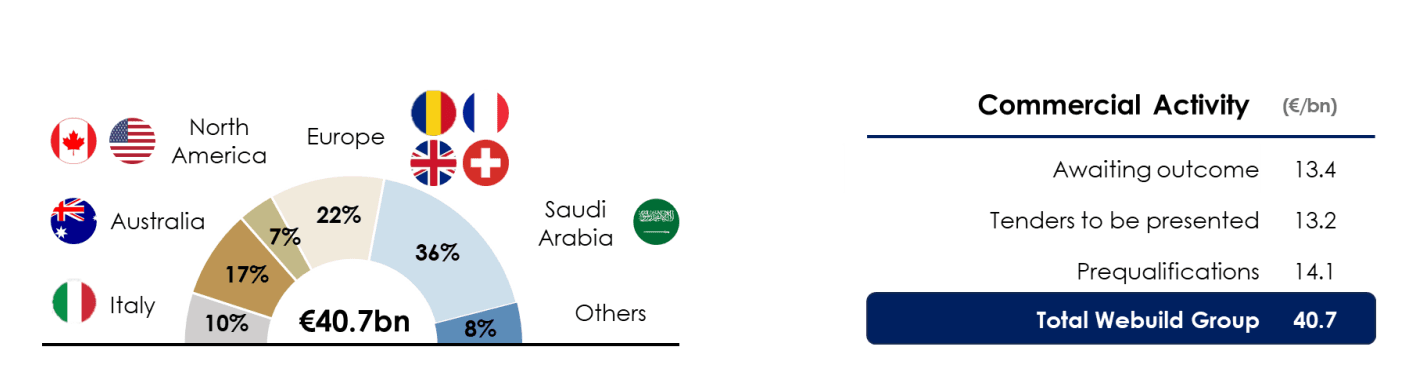

The Group's overall commercial pipeline amounts to about €40.7 billion. It includes . Below is a breakdown of the pipeline by category and geography:

Webuild continues to monitor markets deemed to be strategic, including western and northern Europe, Italy, Australia, and North America. These markets account for more than 55% of the total pipeline.

****

OUTLOOK

The execution of current projects and the significant order intake allow the Group to confirm its financial outlook for 2023:

- Book to bill: >1.1X

- Revenues: €9.0 – 9.5 billion

- EBITDA: €720 – 760 million

- Maintain positive net financial position (net cash)

****

Massimo Ferrari, as Manager in charge of preparing the corporate accounting documents, declares, pursuant to paragraph 2 of art. 154-bis of the TUF, that the accounting information contained in this press release corresponds to the state of the documentary evidence, books and accounting records.

****

The Group will present its results for the first half of 2023 to the financial community on July 28, 2023 during a conference call at 9:00 a.m. CET (UTC +01:00).

For information, please refer to the contact details at the end of this press release.

****

Disclaimer

This press release contains forward-looking statements. These statements are based on the Group's current expectations and projections regarding future events and, by their nature, are subject to an inherent component of risk and uncertainty. They are statements that relate to events and depend on circumstances which may or may not happen or occur in the future and, as such, undue reliance should not be placed on them. Actual results may differ even significantly from those announced due to a variety of factors, including: volatility and deterioration of capital and financial markets, changes in commodity prices, changes in macroeconomic conditions and growth economic and other changes in business conditions, of an atmospheric nature, due to floods, earthquakes or other natural disasters, changes in legislation and the institutional context (both in Italy and abroad), difficulties in production, including constraints in the use of plants and supplies and many other risks and uncertainties, the majority of which are beyond the control of the Group.

The data reported are adjusted economic data; for details, see the table attached to the press release